Simplify your finances and improve your financial life - credit cards, auto loans, personal checking, personal savings, mortgages.

News and Offers

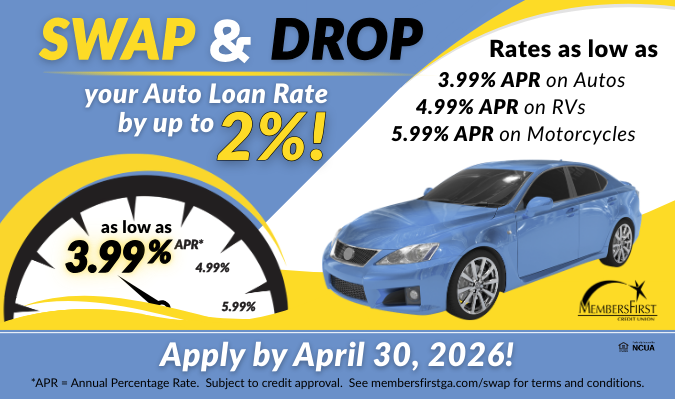

Swap & Drop Auto Refinance

DROP your rate by 2% when you SWAP your auto loan to MembersFirst by April 30, 2026! Rates are as low as 3.99% APR!*

Plus, ask about our great rates on Motorcycles and RVs! Click below to learn more!

Fraudulent Phone Calls

We have received several reports that our members and those of other financial institutions are receiving fraudulent “spoofing” phone calls.

Visit our Fraud Alerts page to learn more.

Update: Alexander High School Branch

The MembersFirst Credit Union branch located at Alexander High School permanently closed effective Wednesday, March 4th, 2026.

Click to learn more about alternative cash and branch access options.

Recognizing and Avoiding Survey Fraud

Survey scams are everywhere, and they all follow the same playbook: lure you in with promises of cash or gift cards, then trick you into sharing personal or financial details.

Credit Card Rates |

APR* |

| Visa Platinum with Rewards | 8.99% |

| Visa Classic with Rewards | 13.88% |

| Visa Secured with Rewards | 14.88% |

Auto Loan Rates |

APR* |

|

| 36 Months | as low as | 4.15% |

| 48 Months | as low as | 4.30% |

| 60 Months | as low as | 4.45% |

*APR=Annual Percentage Rate.

Not a Member?

Enjoy great rates, valuable member perks and unmatched service when you join MembersFirst Credit Union.

Join Today!

Already a Member?

OR

Log in to online banking and choose Apply for a Loan from the menu:

Want to Apply for a HELOC? Click here.