Simplify your finances and improve your financial life - credit cards, auto loans, personal checking, personal savings, mortgages.

News and Offers

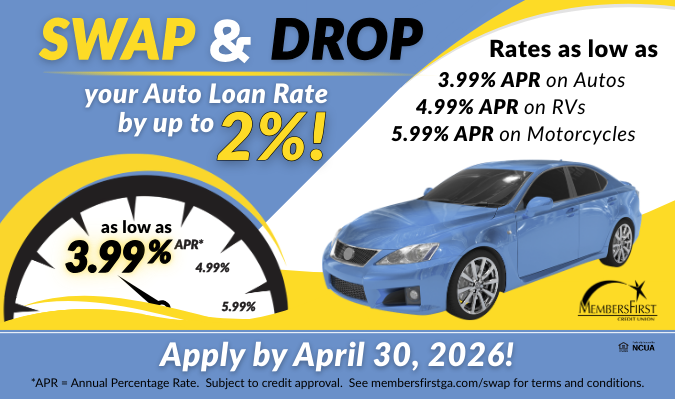

Swap & Drop Auto Refinance

DROP your rate by 2% when you SWAP your auto loan to MembersFirst by April 30, 2026! Rates are as low as 3.99% APR!*

Plus, ask about our great rates on Motorcycles and RVs! Click below to learn more!

Fraudulent Phone Calls

We have received several reports that our members and those of other financial institutions are receiving fraudulent “spoofing” phone calls.

Visit our Fraud Alerts page to learn more.

Follow Us On Facebook

Like and follow MembersFirst on Facebook (@membersfirstcu) and Instagram (@membersfirstcu) for lots of great deals and money-saving tips and tricks!

5 Money-Saving Tips for Millennials (or anyone who wants to save!)

Struggling to save money in today’s economy? You’re not alone. Whether you’re a millennial or just looking for smarter ways to stretch your dollars, these five creative tips can help you cut costs without sacrificing your lifestyle. From cashback apps to meal planning, discover practical strategies to boost your savings and take control of your financial future.

Credit Card Rates |

APR* |

| Visa Platinum with Rewards | 8.99% |

| Visa Classic with Rewards | 13.88% |

| Visa Secured with Rewards | 14.88% |

Auto Loan Rates |

APR* |

|

| 36 Months | as low as | 4.15% |

| 48 Months | as low as | 4.30% |

| 60 Months | as low as | 4.45% |

*APR=Annual Percentage Rate.

Not a Member?

Enjoy great rates, valuable member perks and unmatched service when you join MembersFirst Credit Union.

Join Today!

Already a Member?

OR

Log in to online banking and choose Apply for a Loan from the menu:

Want to Apply for a HELOC? Click here.