If you’re like many of us, you’ve been trying to stick to a budget for a while, but by the time each month is over, you’ve busted your budget – again.

Because of this recurring pattern, you’re probably wondering if there’s a better way. Fortunately, there is.

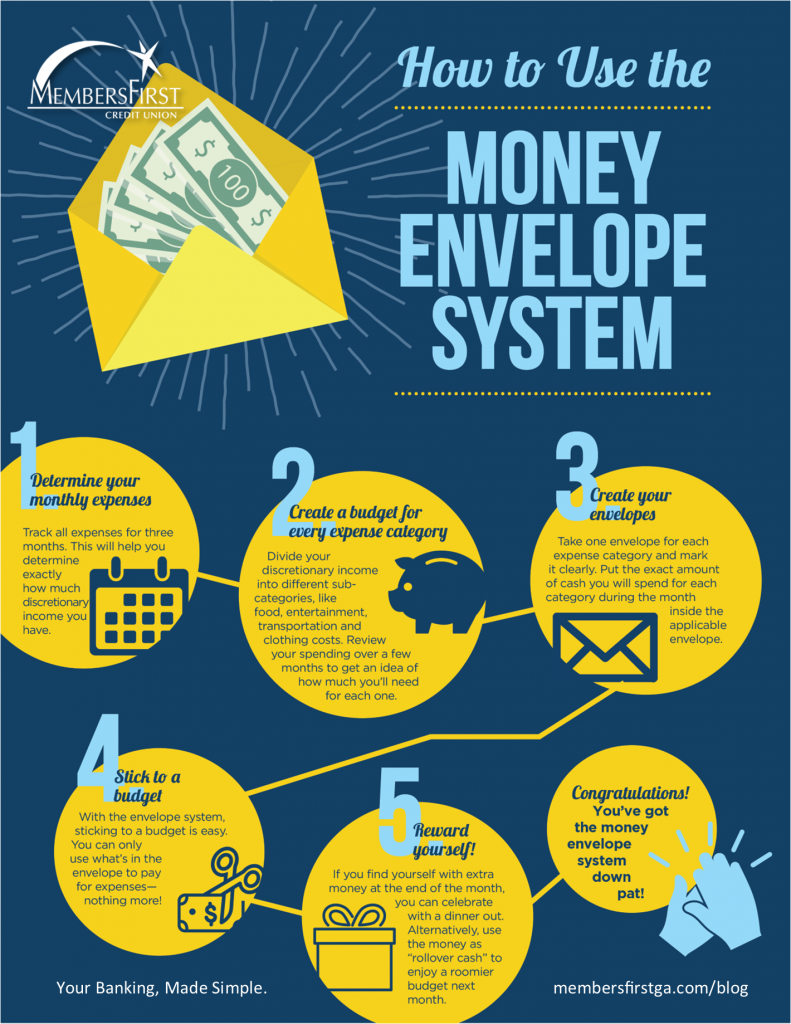

The money envelope system has been around for years, and it’s an incredibly motivating and powerful way to keep spending in check.

You can use this handy guide to understand and implement the money envelope system in your household.

1. Determine your

monthly income and expenses

(If you already have a

workable monthly budget, you can skip to step 2.)

For the next few months, track all of your expenses. You can use MoneyDesktop (located within online banking) or hold onto every receipt or record each purchase you make, being sure to indicate which category of expense it falls under. Hold onto every pay stub, too. When a three-month period has passed, sit down to figure out exactly how much discretionary income you’re left with each month. This will not include fixed amounts, like insurance premiums, mortgage payments, savings and investments.

2. Create a budget for every expense category

Now, divide your discretionary income into different categories. The categories you need and the amounts you’ll set aside for each will depend on your individual lifestyle and habits, but you’ll likely need categories for food, gas, entertainment, transportation and clothing costs.

Review the way you’ve been spending your money in the last few months for an idea of how much you’ll need to set aside for each category. If you see you’ve been overspending in a certain area, this is a great time to resolve to cut back.

3. Create your envelopes

This is where the money envelope system differs from a regular budget. Instead of having money set aside for each category in your head, or even scribbled on a paper somewhere, take one envelope for each expense category and mark it clearly. Now, put the exact amount of cash for this month in the envelope for each category.

Do this with every expense category and boom… you’ve created your new budgeting system!

4. Stick to your budget

As in any budget, following through on a plan is the hardest part. With the envelope system though, it’s a whole lot easier.

Say you need to make a grocery run. You’ll peek inside your “groceries” envelope, take note of how much cash is inside, and figure out how much you can afford to spend. Take that amount of money to the store with you, and only use that cash. No cheating! There’s absolutely no card-swiping allowed and no sneaking money from another envelope to beef up a skimpy cash supply in another. You need to work with what you have.

Instead of walking out of the store with a dozen items in hand that weren’t on your list, you’ll be forced to stick to your budget. And, if you find yourself running low on grocery money one month, you’ll have to make do. You can take the pantry challenge and dream up a menu created around the ingredients you have on hand, or you can shop the sales and cook according to what’s cheapest this week.

Do whatever it takes – but no cheating!

5. Reward yourself!

If you find yourself with extra money in any category at the end of the month, it’s OK to celebrate. Dave Ramsey recommends rewarding yourself with a dinner out or an expensive dessert. Alternatively, you can treat that money as “rollover cash” and use it to enjoy a roomier budget next month.

Tips and tricks

Here are some variations and different approaches to this ingenious system:

- Use a small accordion file folder instead of individual envelopes. It’ll be easier to keep track of your envelopes when they’re all in one place, and it’s sturdier than paper envelopes.

- Go cashless! Love the idea but hate the thought of only using cash? You can still use the envelope system with some minor adjustments. There are free and paid apps designed to create virtual envelopes for you to use, such as Mvelopes and Goodbudget. You can also use a cost-free budgeting app that allows you to divide and track your spending into different categories, such as our app, MoneyDesktop, or Quicken and Monefy.

- Trim your fixed expenses. If you’re finding it difficult to stick to your self-created budget, try to cut back on your non-discretionary spending. Search for a cheaper auto insurance plan. Ditch your cable. Find ways to trim your electric bill and gas expenses. Use the money you save to add to the envelopes that never seem to have enough to get you through the month.

- Create an emergency envelope. Set aside $20 or $50 to use in case another envelope runs out of money.

Congratulations! You’ve got the money envelope system down pat! Here’s hoping it helps you on your journey toward financial wellness.