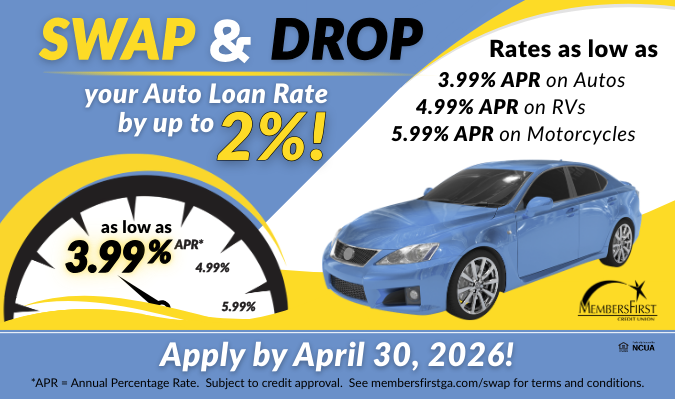

Swap and Drop

DROP your rate by 2% when you SWAP your auto loan to MembersFirst by April 30, 2026! Rates are as low as 3.99% APR!*

Plus, ask about our great rates on Motorcycles and RVs! Click to learn more!

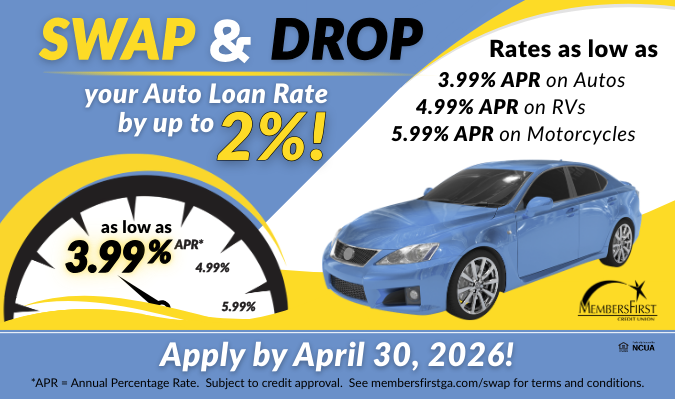

DROP your rate by 2% when you SWAP your auto loan to MembersFirst by April 30, 2026! Rates are as low as 3.99% APR!*

Plus, ask about our great rates on Motorcycles and RVs! Click to learn more!

Whether you are looking to master the basics of budgeting or dive into specialized topics like achieving early retirement, this curated list provides a roadmap to help you navigate your financial journey.

Here are some top picks, complete with direct links to start listening. Click to read more.

If you’re looking for the ultimate guide to success, why not take advice from a billionaire? In Life of Your Dreams, author Mark Pentecost will teach you how to change your mindset, build a support network and create an action plan to achieve goals you’d never dreamed were attainable. Pentecost overcame tremendous challenges on the way to ultimate success, and he’ll teach you how to do the same.

Click the image above to learn more about this book.

If you’re like so many who are looking to take control of your #money and make it work for you, you need to read The Money Habit: The Worry-Free Way to Financial Independence by Mike Michalowicz. He lays out how to attain your financial goals without strict budgets, how to get your finances in line with your lifestyle and goals and how to eliminate debt along with much more you’ll want to add to your financial toolbox.

Click the image above to learn more.

The MembersFirst Credit Union branch located at Alexander High School permanently closed effective Wednesday, March 4th, 2026.

Click to learn more about alternative cash and branch access options.