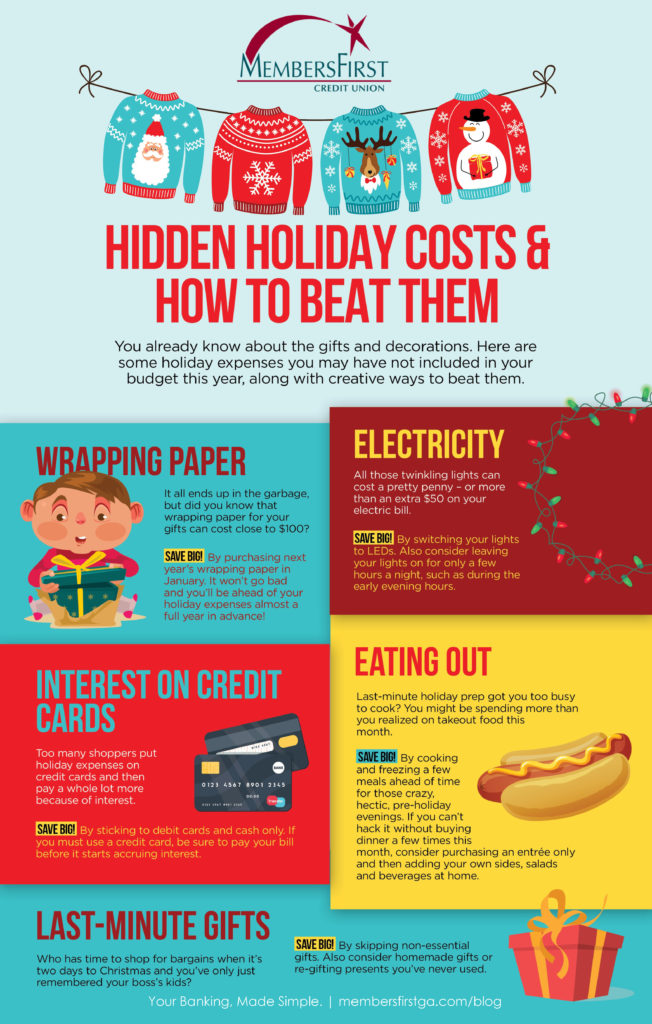

You already know about the gifts and decorations. Here are some holiday expenses you may have not included in your budget this year, along with creative ways to beat them

#1: Wrapping paper

It all ends up in the garbage, but did you know that wrapping paper for your gifts can cost close to $100?

Save big: by purchasing next year’s wrapping paper in January. It won’t go bad and you’ll be ahead of your holiday expenses almost a full year in advance!

#2: Electricity

All those twinkling lights can cost a pretty penny – or more than an extra $50 in your electric bill.

Save big: by switching your lights to LEDs. You can also consider leaving your lights on for only a few hours a night, such as during the early evening hours.

#3: Interest on credit cards

Too many shoppers put holiday expenses on credit cards and then pay a whole lot more because of interest.

Save big: by sticking to debit cards and cash only. If you must use a credit card, be sure to pay your bill before it starts accruing interest.

#4: Last-minute gifts

Who has time to shop for bargains when it’s two days to Christmas and you’ve only just remembered your boss’s kids?

Save big: by skipping non-essential gifts. Also consider homemade gifts or re-gifting presents you’ve never used.

#5: Eating out

Last-minute holiday prep got you too busy to cook? You might be spending more than you realized on takeout food this month.

Save big: by cooking and freezing a few meals ahead of time for those crazy, hectic, pre-holiday evenings. If you can’t hack it without buying dinner a few times this month, consider purchasing an entrée only and then adding your own sides, salads and beverages at home.

Don’t forget to set aside savings for the holidays. Next year, make a plan for how you’ll spend your time and money during the busy holiday season and you just might find out how much more merry the season will feel.

Sign up to receive more helpful tips and promotional savings on the right side-bar.