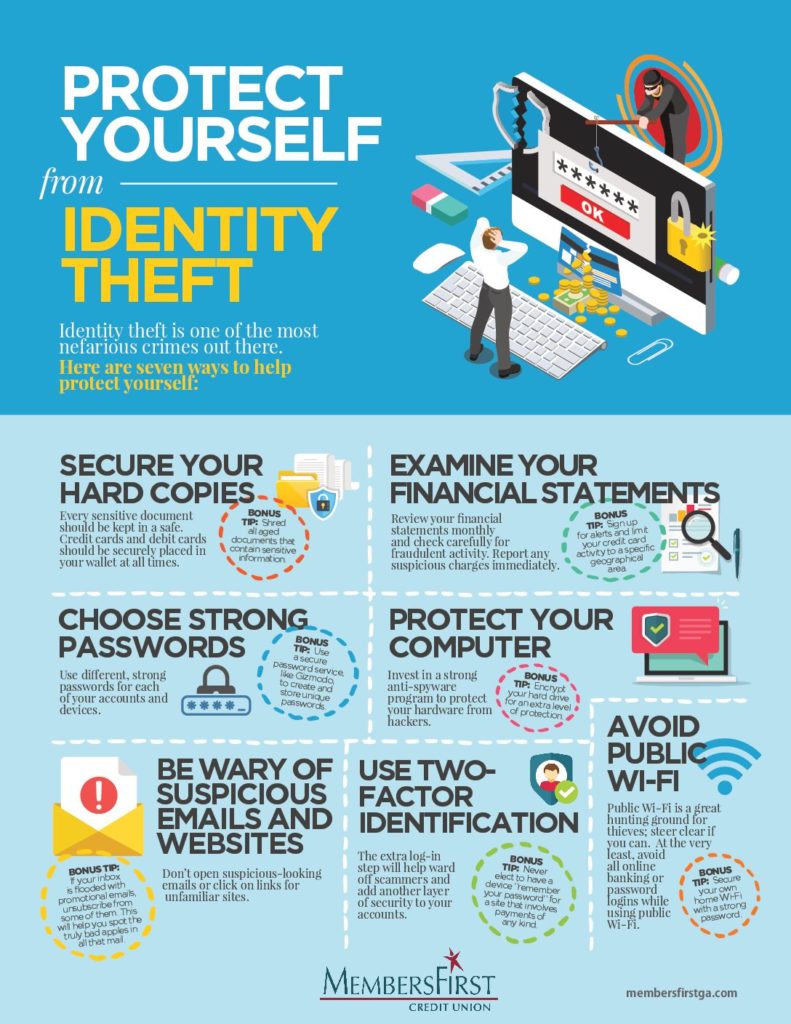

Identity theft is one of the most nefarious crimes out there. Here are seven ways to help protect yourself:

Secure Your Hard Copies

Every sensitive document should be kept in a safe or scanned and saved in a secure folder. Credit cards and debit cards should be securely placed in your wallet at all times.

Bonus Tip: Shred all aged documents that contain sensitive information.

Examine Your Financial Statements

Review your financial statements monthly and check carefully for fraudulent activity. Report any suspicious charges immediately.

Bonus Tip: Sign up for alerts and limit your credit card activity to a specific geographical area. Members, when traveling, let us know when you plan to take a trip so we can open access to your card in that area. Just call us at 404-978-0080.

Choose Strong Passwords

Use different, strong passwords for each of your accounts and devices.

Bonus Tip: Use a secure password service, like LastPass, to create and store unique passwords.

Protect Your Computer

Invest in a strong anti-spyware program to protect your hardware from hackers.

Bonus Tip: Encrypt your hard drive for an extra level of protection. Learn more about encryption here.

Be Wary of Suspicious Emails and Websites

Don’t open suspicious-looking emails or click on links for unfamiliar sites. If you’re unsure of the link, ‘Google’ it first. Usually secure, legitimate websites rank higher in search results and include extra links, ratings, maps and hours for their site or business.

Bonus Tip: If your inbox is flooded with promotional emails, unsubscribe from some of them. This will help you spot the truly bad apples in all that mail.

Use (Multi) Two-Factor Identification

The extra log-in step will help ward off scammers and add another layer of security to your accounts.

Bonus Tip: Never elect to have a device “remember your password” for a site that involves payments of any kind.

Avoid Public Wi-Fi

Public Wi-Fi is a great hunting ground for thieves; steer clear if you can. At the very least, avoid all online banking or password logins while using public Wi-Fi.

Bonus Tip: Secure your own home Wi-Fi with a strong password.

Share this infographics with friends!

7 Ways to Avoid Identity Theft

Take fraud protection into your own hands! When debit cards aren’t in use, especially if you don’t have any plans to use them for a few days, remotely disable them. MembersFirst members, you can temporarily turn access to your cards on and off by simply logging into our mobile app, selecting Remote Control Cards from the menu, choosing the card(s) you want to temporarily deactivate, tapping ‘disable’–and you’re done. When you’re ready to use them again, just log in and tap ‘active’.

As always, if you think you’ve fallen victim to identity fraud, you should alert us and any other financial institution you work with immediately to avoid as much financial backlash as possible.

Your turn! How many of these actions have you then to secure your personal and financial information? Comment below.