How to Beat Inflation and Save on Holiday Shopping

Costs are up across the board, but steep price tags don’t need to lead to a busted budget. You can beat inflation and save on holiday shopping this year. Here are six tips to get you started.

Click the image above to learn more.

10 Hacks for a Stress-Free Thanksgiving (That Won’t Break the Bank)

Whether you’re a pro at hosting or this is your first time hosting Turkey Day, rest easy knowing you can have a calm and stress-free Thanksgiving that doesn’t bust your budget! Check out these 10 Hacks for a Stress-Free Thanksgiving (That Won’t Break the Bank).

However you spend your holiday, we hope you enjoy time with family and friends.

Click the image above to read the post.

How to Choose the Investments That Are Right for You

Getting into investing can be daunting. There are so many kinds of investments for so many purposes … how can you choose? Fortunately, we’ve put together a guide to help.

Read on to learn a few of the most common investment types for beginners. For a more in-depth experience, set up a free consultation with a dedicated financial advisor interested in helping you reach your goals.

Click the image above to learn more.

Welcome, Savastate Teachers FCU!

We’re thrilled to announce members of Savastate Teachers Federal Credit Union joined the MembersFirst Credit Union family on September 1, 2023. Now, more than 700 new members and their families have access to the same great benefits you enjoy every day!

Click the image above to read more about Savastate and how they serve Savannah State University. Welcome, Savastate!

How to Make Yourself Recession-Proof

One way or another, we’re all feeling the impact of an unstable economy. Luckily, there is plenty you can do to lessen the impact a recession has on your wallet. In this FREE e-book, we’ll cover:

• What’s a recession anyways?

• How do I prepare for a recession?

• Is inflation here to stay?

• How to budget in times of inflation

• How to insulate your investments against inflation

Click the image above to read more and download your free e-book.

5 Steps to Take When Starting to Invest

Choosing to begin investing before making a plan and knowing where you stand financially is a little like putting the cart before the horse. In order to make the biggest impact for your best possible return, there are a few steps to consider before finally deciding when, how much and in what way your funds will begin working for you.

Click the image above to learn the 5 Steps to Take When Starting to Invest.

What’s Your Retirement Outlook?

While there is no way to definitively know what your retirement will look like, there are steps you can take now to be in the best shape possible. Prepare now, regardless of where you are in your work life.

Click the image above to learn more about preparing for retirement.

50 Budget-Friendly Activities to Try This Summer

It’s summertime! Get ready for long, lazy days filled with moments that are sure to become priceless memories for you and your family. And the best news? It doesn’t have to cost much at all. Here are 50 budget-friendly activities to try this summer.

Click the image above to learn more.

Does Good Debt Exist?

Despite its bad rap, not all debt is bad debt. Some debts are actually beneficial for the debtor and can be considered “good debt.” Let’s take a look at the factors defining good debt, the various types of good debt and how to keep this debt from going bad.

Click the image above to learn more.

Money and Mental Health

May is Mental Health Awareness Month. Let’s take a look at the connection between money and mental health. By managing your finances and seeking help when needed, you can improve your mental health and overall well-being. Click the image above to learn more about the connection between money and mental health and managing financial stress.

5 Ways to Trim Fixed Expenses

When most of us make our monthly budget, we list our fixed monthly expenses and move on from there; however, taking a closer look at those can save you money! You can cut your monthly bills and squeeze more out of your budget!

Click the image above to read more.

Book Review: The Art of Bouncing Back

We all have setbacks at some point in life, whether emotional, financial, physical or a combination. Darleen “Coach Dar” Santore’s new book, The Art of Bouncing Back, will teach you recovery skills and reframing techniques to turn around whatever has you down and come out the other side stronger and healthier. With 25+ years of experience, Santore can help you overcome any negative situation. Give it a read!

Click the image above for a brief overview.

6 Financial Lessons You Can Learn from Basketball

Whether it’s March Madness or post-season, there are some surprising financial lessons we can learn from basketball and its players. Let’s take a look at these 6 financial takeaways we can learn from the iconic sport.

Click the image above to learn more.

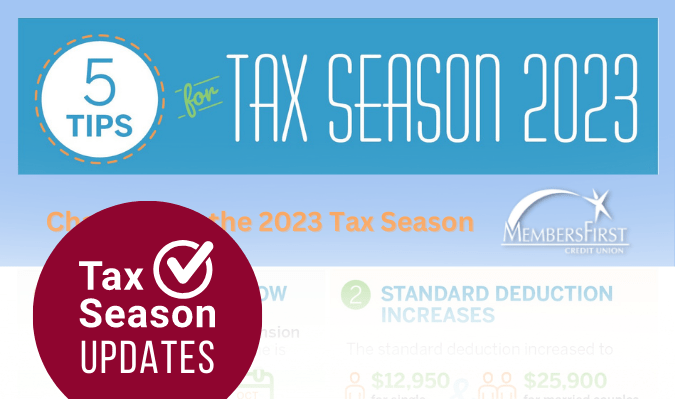

5 Tips for 2023 Tax Season

Tax season is upon us once again. Each year, the IRS makes changes to deductions and tax brackets, among other areas. Click the image above for 5 tips for the 2023 tax season you should know.

12 Steps to Financial Wellness

Are you ready to embark on a journey toward financial wellness? Achieving and maintaining your financial health is a life-time pursuit. We’ve outlined the 12 foundational steps toward achieving financial wellness and making it last. In each step, we’ll tackle the topic in detail to help you learn all you need to know about that particular aspect of financial health. Follow along, and at the end of the process, you’ll have mastered the tools for a lifetime of financial wellness.

Click the image above to access the 12 Steps to Financial Wellness!

How to Have the Money Talk with Your Partner

Talking finances with your partner may not be your idea of a shared romantic moment, but communicating openly about how you manage your money is a crucial part of having an honest and trusting relationship. We’ve compiled six tips to help guide you in this important conversation.

Click the image above to learn more. Don’t forget our Certified Credit Union Financial Counselors are here to lend a non-biased opinion and guide you toward healthy financial choices.

Everything You Need to Know About Money Market Accounts

If you’re looking for a way to make your money grow faster but still keep it under the credit union’s insurance umbrella, think about a money market account! It’s like combining the benefits of a savings account with a checking account, but you get a higher interest rate in return for slightly limited access to your money. Read on for everything you need to know about Money Market accounts.

5 Reasons to Open a Money Market Account

Want more from your money? Savings accounts are an ideal home for funds you want to put away for emergency or special purposes. Checking accounts are the way to go for money you will spend on living expenses. But, what if there were a way to take everything you love about your savings account and put it together with the best parts of your checking account in one fantastic account? Let’s take a look at Money Market accounts.

Smishing Scams

In this day and age when apps can almost run our lives for us, the humble SMS, or text, has outlived them all – and it’s still going strong. Unfortunately, though, texting has come under attack as one of the most vulnerable mediums for financial and identity theft known as smishing. Read on about what to look for and how to protect yourself.

Back-to-School Shopping Hacks

It’s back-to-school shopping season, but that doesn’t mean you need to spend yourself broke! Cash in on savings with these hacks and get your shopping done without breaking your budget.