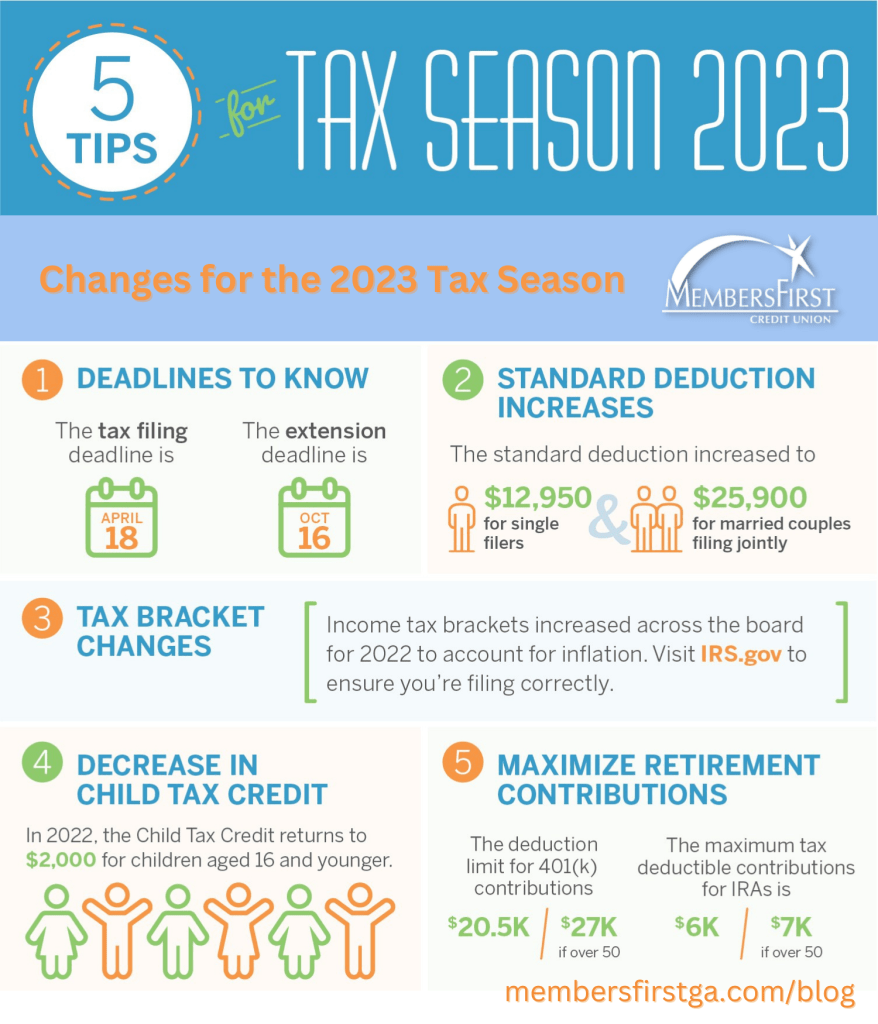

Tax season is upon us once again. Each year, the IRS makes changes to deductions and tax brackets, among other areas…here are 5 tips for the 2023 tax season you should know. (Scroll down for a shareable infographic.)

Deadlines to know

- The tax filing deadline is April 18, 2023.

- The extension deadline is Oct. 16, 2023.

Standard deduction increases

For 2022, the standard deduction increased to $12,950 for single filers and $25,900 for married couples filing jointly.

Tax bracket changes

Income tax brackets increased across the board for 2022 to account for inflation. Visit IRS.gov to ensure you’re filing correctly.

Sell loser stocks to offset capital gains

Selling stocks or assets that have lost value during the year enables you to deduct the loss from any capital gains you’ve made and only pay taxes on the difference.

Maximize your retirement contributions

- The deduction limit for 401(k) contributions for 2022 is $20,500, or $27,000 if you’re over the age of 50.

- The maximum tax-deductible contribution for IRAs is $6,000, or $7,000 if you’re over the age of 50.

Staying on top of changes will turn you into a tax pro! If you’re not quite comfortable doing your taxes alone, check out the discounted tax preparation services made available to your through the Love My Credit Union Rewards program, right here at MembersFirst!

Don’t forget…earn interest on your return by investing in a MembersFirst Credit Union savings product!

Right-click on the image below to share or save.